- Gross annual income: $150,000

- Terrible month-to-month money: $a dozen,five hundred

- Month-to-month education loan percentage: $step 1,200

- Month-to-month car repayment: $850

This situation means two who to each other make $150,000 a year. Their terrible monthly money is approximately $several,five hundred. Utilizing the signal, this partners is theoretically afford as much as a great $cuatro,2 hundred mortgage payment-plenty of getting a great $400K house.

not, so it partners provides education loan repayments of $1,2 hundred per month and car and truck loans totaling $850 30 days. A great $4,2 hundred mortgage payment and additionally its other financing repayments means $six,250 monthly. This total obligations responsibility would be doing 42% of its $150,000 income, definition they cannot remove a mortgage within twenty eight% of the gross month-to-month money.

Bookkeeping due to their loans, they’re able to just spend https://speedycashloan.net/personal-loans-ri/ $step 3,350 month-to-month into home financing. It indicates the happy couple you may afford $400,000 having room to help you free. In reality, if they purchase good $eight hundred,000 domestic rather than the restrict number a lender allows, they might make use of the huge difference to pay down the established pupil loan and you may car finance debt.

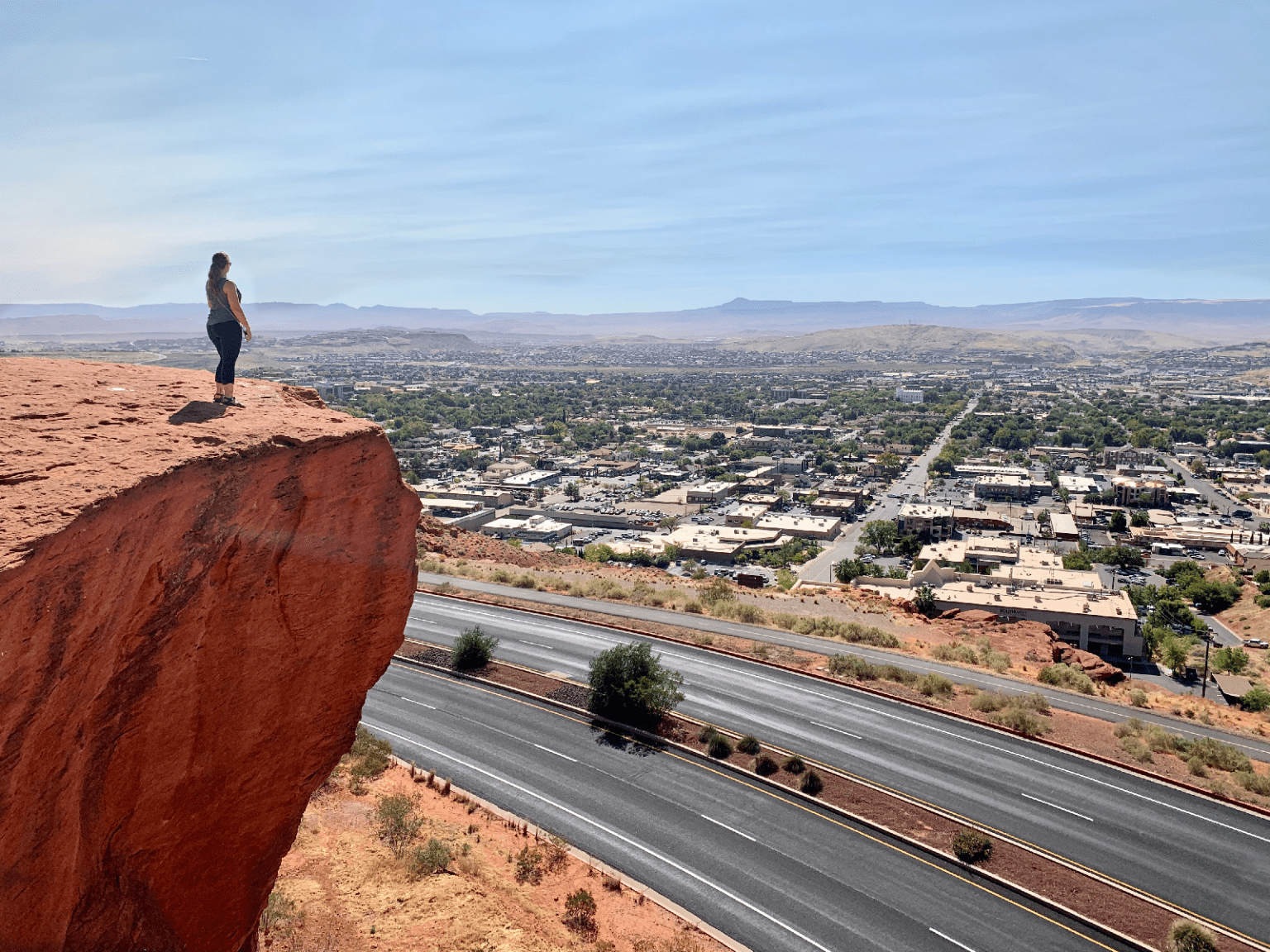

Research regarding National Relationship from Real estate agents suggests the most affordable houses from the U.S. have been in the newest Midwest and South. The newest average conversion process price of established single-family members home on the Southern area is roughly $360,000, while the median conversion speed regarding the Midwest is even shorter around $283,000.

One may find property throughout the Northeast in the $eight hundred,000 diversity due to the fact median is approximately $441,000, however, prevent the west Us, the spot where the average family pricing is simply over $600,000.

Just how to Qualify for a great $400K Home

If you’re an initial-time homebuyer, the newest measures to being qualified for a mortgage may seem daunting. Although not, the procedure becomes more simple understanding exactly what loan providers consider when contrasting you to possess a home loan.

Lenders can look at your credit file to see whether or not otherwise not you really have profile from inside the range otherwise a reputation case of bankruptcy. They will also assess your debt-to-earnings proportion, accessibility your credit score and you will opinion your lender statements.

It could getting invasive having loan providers to adopt all facets of the credit history, however, to track down a mortgage, lenders have to determine the right you’re going to make your home loan repayments punctually. Here are the tips to take so you’re able to be eligible for a beneficial $400,000 domestic.

Step 1: Remove Your own Credit report

An individual Economic Safety Bureau received nearly 450,000 grievances regarding the credit report errors within the 2023. Thus, before you can prequalify to own a home loan otherwise go household looking, remove a free content of your credit report, that you’ll manage at the AnnualCreditReport. Look at the credit history meticulously to make sure you cannot have problems involved.

Step two: Prequalify to own a home loan

Pre-qualifying occurs when you fill in the very first guidance, such as your money and you can Public Coverage count, to some lenders. They use this article to give you a tentative decision into even though they had accept your for a mortgage.

Its choice isnt joining which will be subject to the filling away a full application immediately after trying to find property you adore. It is preferable so you’re able to prequalify to possess home financing since if we want to installed a deal into a property, that have a good prequalification mention reveals you will be a serious buyer.

Step three: Pick a home You adore and you may Officially Implement

Home looking is the best element of qualifying to possess a home loan. After you pick property you like and also the merchant accepts your own give, fill out a formal financial app on bank you decide on. The application and you may financing operating period takes doing 31-60 days, based the bank.