Part Manager, Mortgage Administrator | Obligations Coach | Mortgage loans Made simple

If you are planning using a divorce proceedings, separated, otherwise given a split up and you very own a texas home together which have home financing up coming you will have problems that have to become addressed. Most of the mortgage officers try unwell prepared to help efficiently and in case they’re not a colorado bank they might not consider special Tx financing rules new incorporate to separation and divorce refinancing and you will credit.

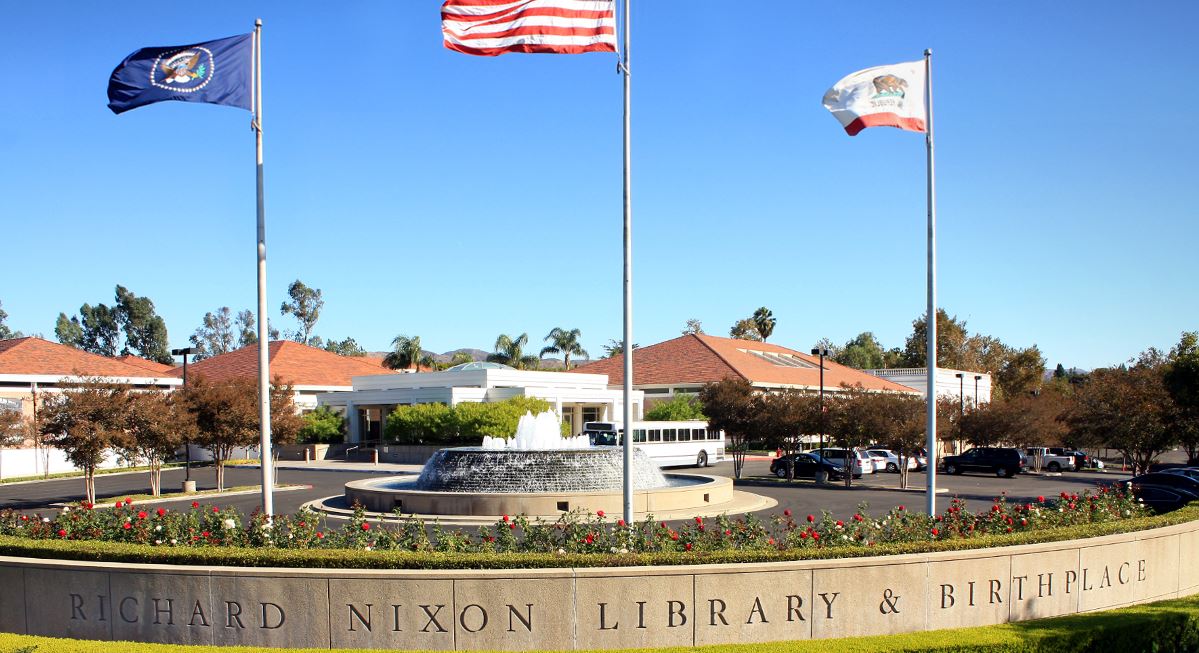

Richard Woodward

An expert divorce case cluster has a range of class users together with the newest attorneys, economic planner, accountant, appraiser, intermediary and sure, a splitting up credit professional. All party associate keeps a critical character making sure new divorcing visitors is decided to succeed article decree. A credit elite well versed throughout the understated subtleties from split up lending provides brand new monetary studies and expertise away from a very good wisdom of your own union anywhere between Divorce proceedings and you may Family relations Legislation, Irs tax regulations and home loan financial support procedures while they all associate to help you a property and you can divorce or separation.Richard Woodward Official Divorce case Credit Expert

Richard Woodward are a tx home loan company that focuses primarily on helping property owners settle those financial things. Their mission is always to help you with the task off rewarding new separation and divorce decree plus that gives everything you need and need.

Usually the mortgage on your house is the biggest responsibility a good divorcing pair has to separated. Divorcing one to financial isn’t really simple and easy this new split up decree is actually just the start. On eyes of lending company/owner your are married and to one another liable for the mortgage until your offer our house, among your imagine the loan, or refinance the brand new small print of one’s newest home loan removing a for any partner leaving the home.

Whether or not your separation and divorce decree says your most other partner have a tendency to be responsible for the loan this will maybe not eliminate the most other companion in the obligations of your mortgage. When one another spouses signed the initial financial documents they agreed to end up being jointly accountable for paying it financing up to it is repaid regarding.

Promote our home: one of many easiest ways to eliminate everyone’s liability in the financial when bringing a separation and divorce is my attempting to sell your house. This new arises from the new marketing tend to first be used to shell out off the present home loan and you can anything left-over once settlement costs would-be used to be considered of the splitting up decree or breakup contract.

Essentially, it is conformed that it’s a good idea to offer the home in advance of the divorce try finalized to cease coming fights more than product sales prices and continues. And additionally, neither people should be worried about deciding to make the mutual home fee, maintaining our house, otherwise investing taxation and you will insurances.

Refinance the borrowed funds: here is the most typical method whenever you to partner desires hold the household. Fundamentally, the latest mate who wants to keep their house refinances the borrowed funds for taking title of the most other partner out-of and can has only label on house.

If there’s security that needs to be common most financial applications cannot deem brand new re-finance while the payday loans Hidden Lake, CO a cash-out re-finance. Really mortgage applications support higher mortgage so you can thinking and no penalties on security that will making your house. This helps from inside the much easier qualification, down rates of interest, much less settlement costs. In the Colorado, you will find most particular statutes and functions to follow of a keen software entitled an enthusiastic Owelty Action. Click the link for more information

Financial Presumption: there are many mortgage programs that allow for credit qualification mortgage assumption. If the current financial is actually sometimes a FHA, Virtual assistant, otherwise USDA your home loan have a for any ability to be presumed, most other loan apps are not assumable but check with your lender to be certain.