You should consult with your accountant to see how they prefer this section of the chart of accounts to be organized. One note, however, you should never see a balance in an account called “Opening Balance Equity.” If you have one, you can guarantee your books need a bit of cleanup. For this reason, we keep the equity accounts In our winery chart of accounts template, very generic. The chart of accounts generally lists the most liquid assets first (cash and equivalents) and moves from there to the less liquid assets (property and equipment).

- For example, “work-in-progress” for aging wine, or “finished goods” for ready-to-sell bottles.

- This method values inventory based on the average cost of all similar items available during the period.

- The process of applying overhead costs should evolve over time as operations become more complex, and so too should the allocation methodology—without negatively impacting consistency.

- Sometimes the accounts you need will be dictated by your business structure.

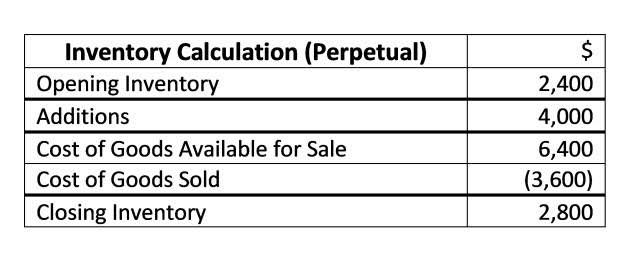

- Inventory valuation is used to determine the value of your stock at any given time, which is important for making informed decisions about buying and selling inventory.

- Tracking your performance using these numbers is vital to maintaining and expanding a profitable business.

Navigating Tax Season: A Food & Wine Business Owner’s Guide to Preparing Your Annual Income Tax Return

There’s a wide gulf between financial reporting and management account reporting. Financial reporting operates under GAAP guidelines and allows your company to remain compliant with policy boards. In contrast, management reporting analyzes department performance as well as its relationship to expenditures and returns on investment (ROI).

Geodrill Generates Revenue of $34.1M, a 13% Increase Compared to $30.3M for Q3-2023

This insight is essential for setting appropriate pricing, managing budgets, and ensuring profitability. Accurate COGS calculations enable better financial planning and decision-making. Protea Financial is here to help you understand the basics of wine accounting so that you can make informed decisions about your business. Protea Financial is here to help you navigate the world of wine accounting. We have a team of experts who are familiar with the ins and outs of this industry.

Wine Costing & Inventory Support

For our core services, we offer simple subscription pricing, so that you always know what you’re going to pay. We work with family-owned wineries from startup to about 10,000 cases. Through our dedication, experience, and expertise L.A.P. Company, Inc. will establish a lasting relationship that will fulfill many of your businesses needs. Chime in on The Punchdown where other like-minded winery professionals go to connect and communicate with one another. If you want to spend your time doing what you do best, let the experts at Protea give you the luxury of not having to think about your books.

- Consequently, it is best to use the simplest method available that provides an appropriate level of precision.

- For this reason, we keep the equity accounts In our winery chart of accounts template, very generic.

- Your accountant can play a key role in helping you establish an appropriate accounting framework ad heping you understand how to read your financial statements.

- The third step in wine accounting is understanding inventory valuation.

- Just because QuickBooks Online makes things easier, it can’t do the work by itself!

- We can provide the tools and resources you need to manage your finances effectively.

Accounting services for wineries

We offer practical advice on managing your winery’s finances with confidence and making informed decisions that support growth. Some winery accounts use the “Other Expenses” bookkeeping section of the chart of accounts to track their wine production costs which are eventually zeroed out as they are capitalized to the balance sheet. This option can work well and has the advantage of keeping these expenses out of the main section of Profit & Loss if you are only calculating and adjusting COGS once a quarter or once a year.

Your Guide to Winery Compliance for Small Wineries in Washington State

Even Intuit, the owner of Quickbooks, knows this, as they are rolling back their support for their QuickBooks Desktop versions. Our first tip is to ensure that whichever bookkeeping software you choose is cloud-based. We are here to help you see your story and move forward with insight and understanding, so you can build your winery business into what it was meant to be. We love to work with forward-thinking winery owners who are ready to adopt tech solutions to streamline their workflows.

What is accrual accounting and why is it important for wineries?

By maintaining detailed financial records, vineyard managers can identify cost-saving opportunities, plan budgets more effectively, and improve overall financial health. This enables better decision-making and enhances the vineyard’s financial stability. Your accountant can play a key role in helping you establish an appropriate accounting framework ad heping you understand how to read your financial statements. We have already talked about the big advantage of accurately measuring your profitability, as opposed to simply your bank balance. Each expense — grapes, bottles, and salaries — gets tucked into a “other expense” account. Once you’ve produced the wine and it’s ready for sale, recalculate the cost of making it and winery bookkeeping move those costs into the inventory accounts.