If a particular asset has the characteristics of a digital asset, it will be treated as a digital asset for federal income tax purposes. If the corporation made any payment in 2023 that would require the corporation to file nol carryover worksheet excel any Form(s) 1099, check the “Yes” box for question 15a and answer question 15b. Otherwise, check the “No” box for question 15a and skip question 15b. See Am I Required to File a Form 1099 or Other Information Return?

Tax planning & preparation

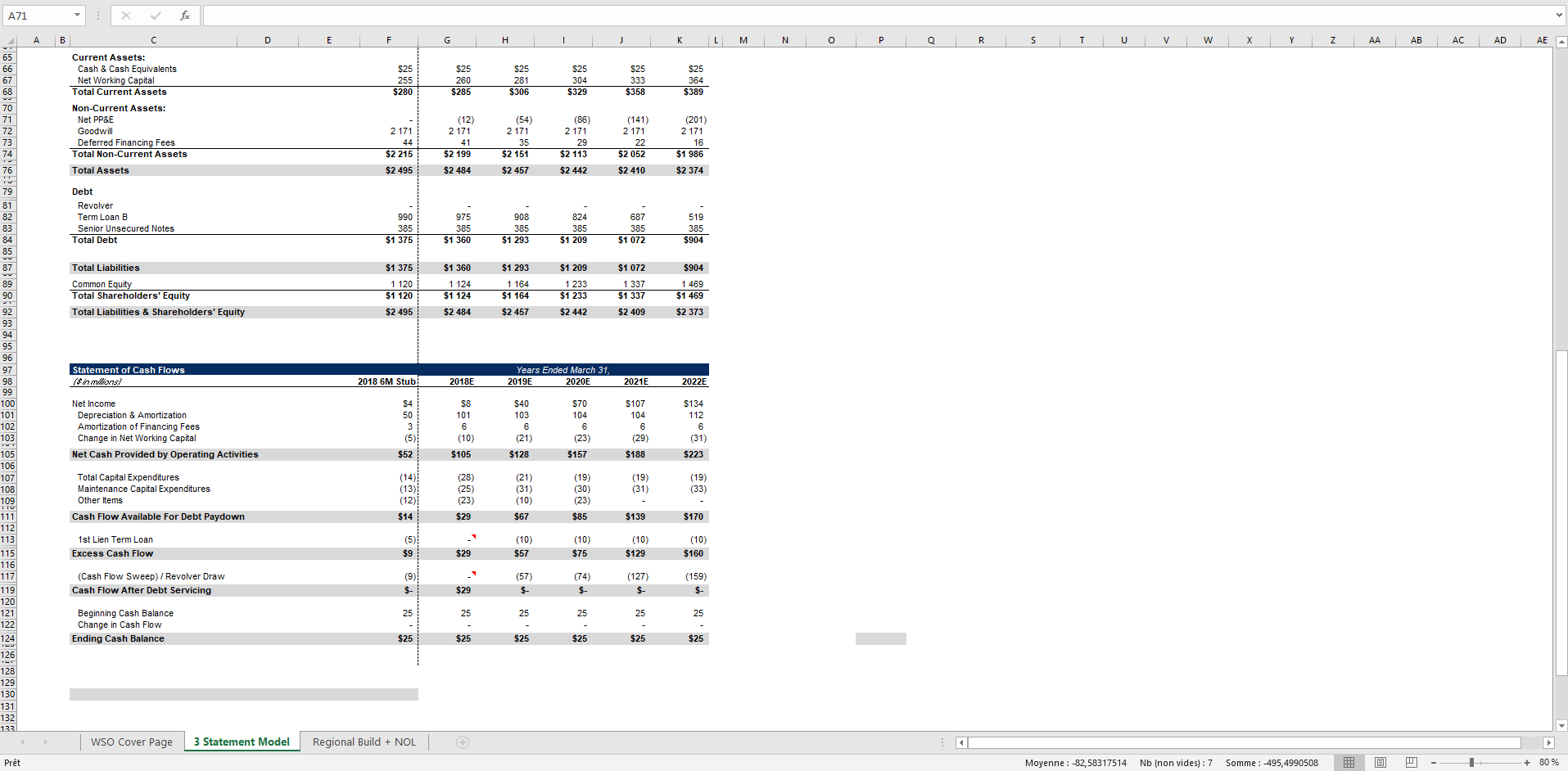

The TCJA removed the two-year carryback provision for tax years beginning Jan. 1, 2018, or later, except for certain farming losses, but allowed for an indefinite carryforward period. However, the carryforwards are now limited to 80% of each subsequent year’s net income. If a business creates NOLs in more than one year, they are to be drawn down completely in the order that they were incurred before drawing down another NOL. You may be entitled to a larger charitable contributions deduction in determining modified taxable income for 2023 (line 19) than the charitable contribution deduction you were allowed in determining 2023 taxable income (line 18). Because of this, the amount you enter on line 20 may be negative.

- Complete Schedule C and enter on line 4 the amount from Schedule C, line 23, column (a).

- Include on line 9z additional taxes and interest such as the following.

- See section 164(d) for information on apportionment of taxes on real property between seller and purchaser.

- Corporations can use certain private delivery services (PDS) designated by the IRS to meet the “timely mailing as timely filing” rule for tax returns.

Who can claim a net operating loss?

See the Instructions for Form 5472 for additional information and coordination with Form 5472 reporting by the domestic DE. If a corporation holds an ownership interest in a FASIT to which these special rules apply, it must report all items of income, gain, deductions, losses, and credits on the corporation’s income tax return (except as provided in section 860H). Show a breakdown of the items on an attached statement. For more information, see sections 860H and 860L (repealed with certain exceptions). To claim the 100% deduction on line 10, column (c), the company must file with its return a statement that it was a federal licensee under the Small Business Investment Act of 1958 at the time it received the dividends.

Product & service classification

See Schedule H (Form 1120), Section 280H Limitations for a Personal Service Corporation (PSC), to figure the maximum deduction. The corporation should keep copies of all filed returns. They help in preparing future and amended returns and in the calculation of earnings and profits. The corporation is not authorizing the paid preparer to receive any refund check, bind the corporation to anything (including any additional tax liability), or otherwise represent the corporation before the IRS. To request a direct deposit of the corporation’s income tax refund into an account at a U.S. bank or other financial institution, attach Form 8050, Direct Deposit of Corporate Tax Refund.

You must attach a statement that shows all the important facts about the NOL. Your statement should include a computation showing how you figured the NOL deduction. If you deduct more than one NOL in the same year, your statement must cover each of them. Your deductions exceed your income by $16,200 ($19,850 − $3,650). However, to figure whether you have an NOL, certain deductions are not allowed.

How a Net Operating Loss (NOL) Works

If a return is filed on behalf of a corporation by a receiver, trustee, or assignee, the fiduciary must sign the return, instead of the corporate officer. Returns and forms signed by a receiver or trustee in bankruptcy on behalf of a corporation must be accompanied by a copy of the order or instructions of the court authorizing signing of the return or form. File Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, to request an extension of time to file.

Except as otherwise provided in the Internal Revenue Code, gross income includes all income from whatever source derived. If the corporation receives its mail in care of a third party (such as an accountant or an attorney), enter on the street address line “C/O” followed by the third party’s name and street address or P.O. Do not use the address of the registered agent for the state in which the corporation is incorporated.

Only NOLs arising after 2017 and carried forward to a year after 2020 are subject to the 80%-of-taxable-income limit. The total amount of any NOL deduction for 2021 or thereafter that is attributable to NOLs from tax years after 2017 can’t exceed 80% of taxable income without regard to the NOL deduction or sections 199A or 250. 80% of the excess (if any) of taxable income computed without regard to deductions for NOLs, or Qualified Business Income (QBI), or section 250 deductions, over the NOLs carried to the year from tax years beginning before January 1, 2018.

Include the NOL deduction with other deductions not subject to the 2% limit (line 15a). Also, see the special procedures for filing an amended return due to an NOL carryback, explained under Form 1040-X, later. If you waive the carryback period or do not use up all of the farming loss in the carryback period, you will have an NOL that can be carried forward indefinitely until used up.