Part Manager, Mortgage Administrator | Obligations Coach | Mortgage loans Made simple

If you are planning using a divorce proceedings, separated, otherwise given a split up and you very own a texas home together which have home financing up coming you will have problems that have to become addressed. Most of the mortgage officers try unwell prepared to help efficiently and in case they’re not a colorado bank they might not consider special Tx financing rules new incorporate to separation and divorce refinancing and you will credit.

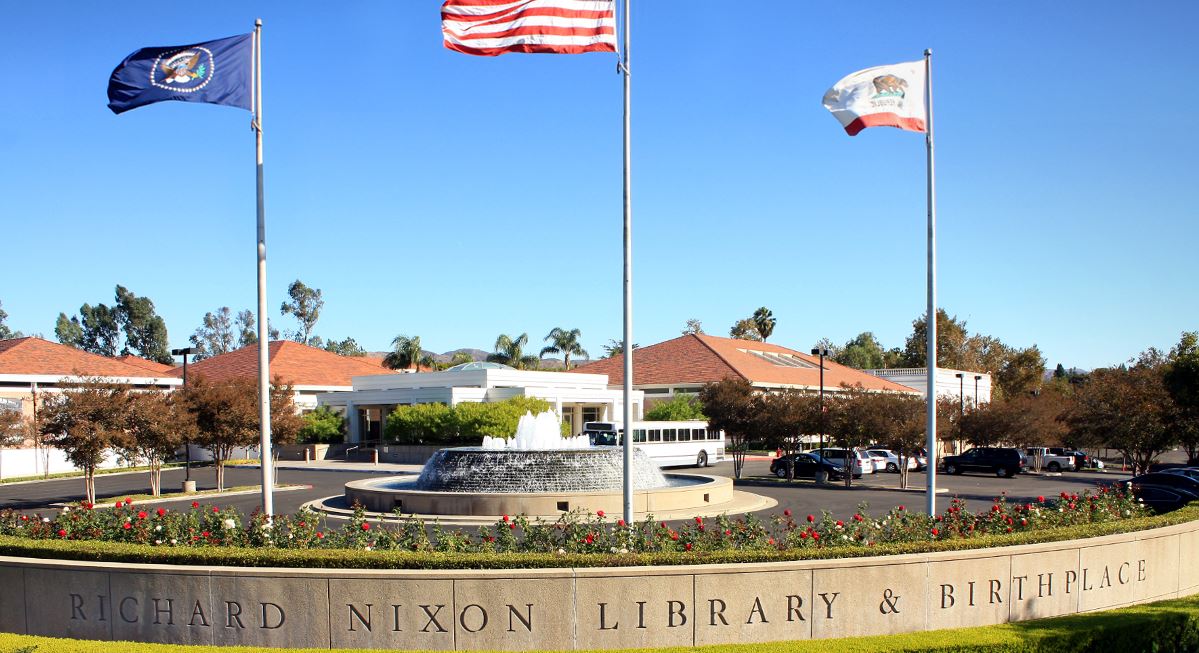

Richard Woodward

An expert divorce case cluster has a range of class users together with the newest attorneys, economic planner, accountant, appraiser, intermediary and sure, a splitting up credit professional. All party associate keeps a critical character making sure new divorcing visitors is decided to succeed article decree. A credit elite well versed throughout the understated subtleties from split up lending provides brand new monetary studies and expertise away from a very good wisdom of your own union anywhere between Divorce proceedings and you may Family relations Legislation, Irs tax regulations and home loan financial support procedures while they all associate to help you a property and you can divorce or separation.Richard Woodward Official Divorce case Credit Expert